In 9 months, Noble’s operations burnt $801m in line with the expectations.

Oil liquids are the core assets of Noble.

One month ago we asked How the “core assets” (contracts) are now performing ? raising serious doubts about real profitability of the business line and its line manager.

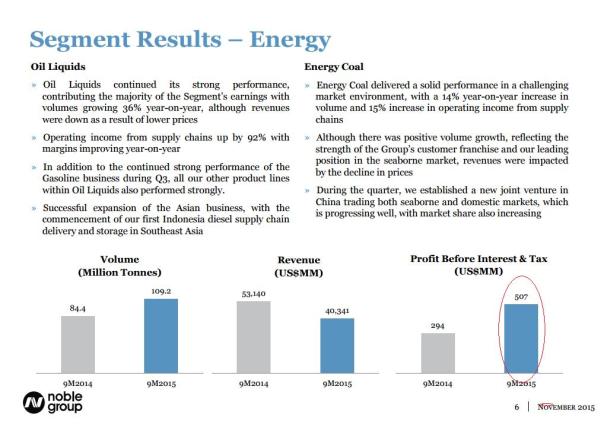

“Oil liquids had an EBIT of $646M in 2015, thanks specifically to three deals on Colonial, Magellan and Explorer pipelines.

Knowing that:

Noble Oil Liquids operates in the [1 – 1.8] % sub-margin band and accounts for more than 70% of the operating income of the supply chains at Noble.

Several traders have cut their bilateral opened-credit lines with the “big swinging dick”.

How the “core assets” (contracts) are now performing ? “

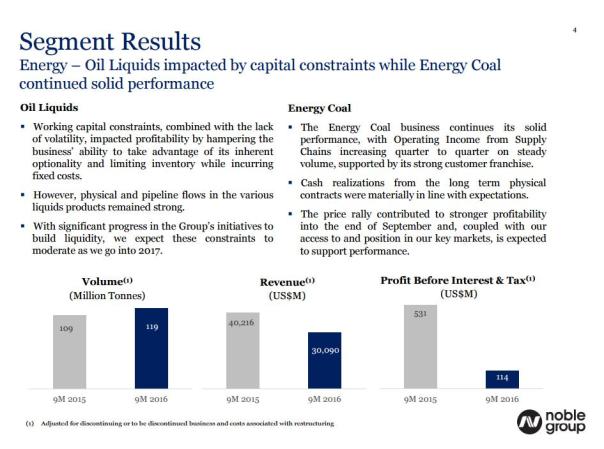

Noble Group 9M-16 Investor Presentation

Note the “However, physical and pipeline flows in the various liquids products remained strong”-Strong deals in the red should be added.

Noble has confirmed that it is losing money since at least 8mth on the pipelines as we predicated earlier.

To get a good appreciation of the situation, one has to go back 2015 take snapshot 9M2015 and realize that the credit lines have been backed by the ebitda indestructibility of the Noble oil liquids segment.

Noble Group, Financial Presentation, 9M-2015

We are in the lose-lose phase and simply cannot believe the banks will go unprotected warehousing the revolving credit facility (RCF) risks.

The credit swap is pricing a default.

The Noble Files 贵族档案