Noble Group Says Listing Top Execs’ Pay Would Hurt Its Standing…

Noble Group Ltd., the embattled commodity trader, has pushed back against guidelines in Singapore for disclosing information on executives’ remuneration.

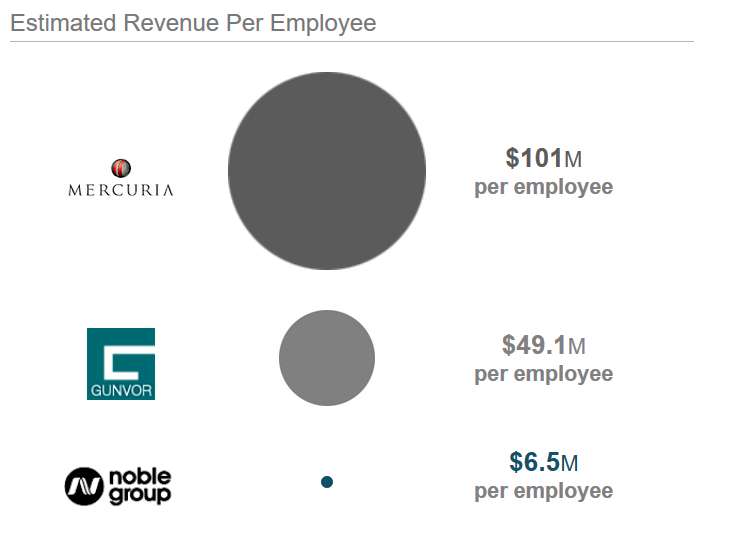

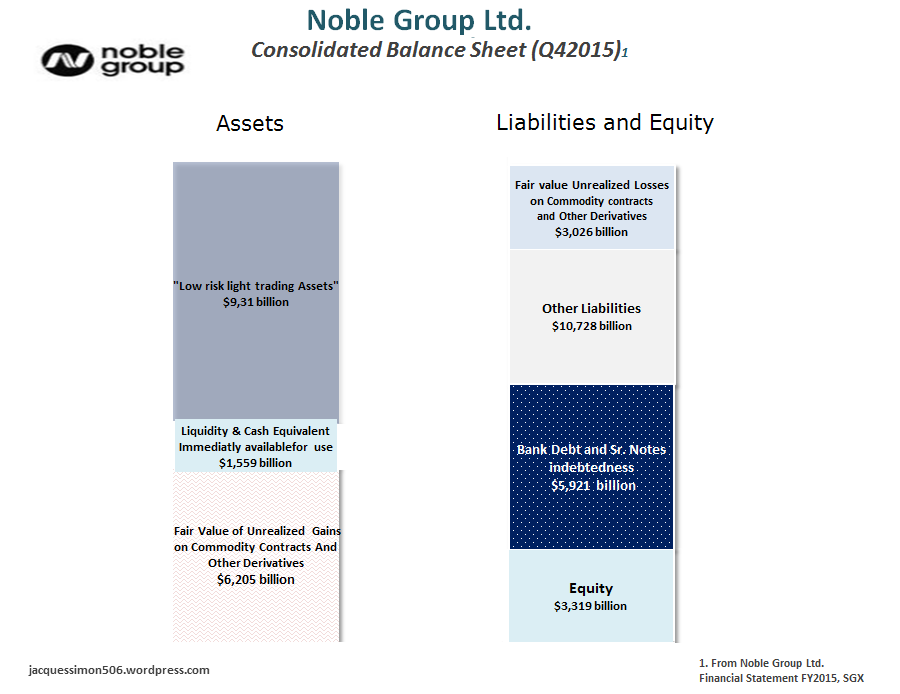

What would hurt more Noble Group’ standing than the compensation of their Managing Directors that the company has refused to advertise in an exchange query: It’s shaky financials.

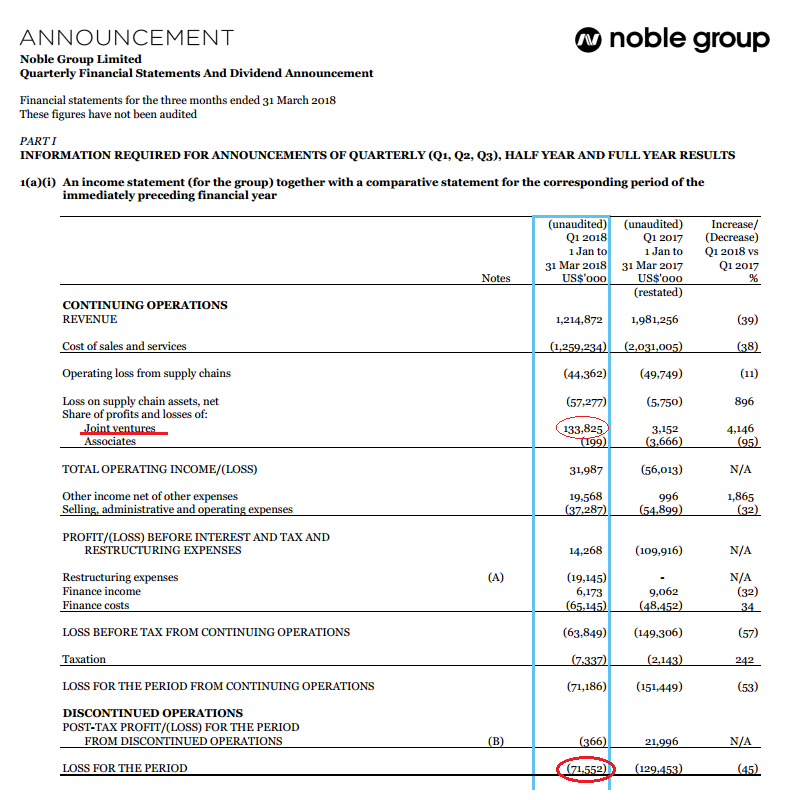

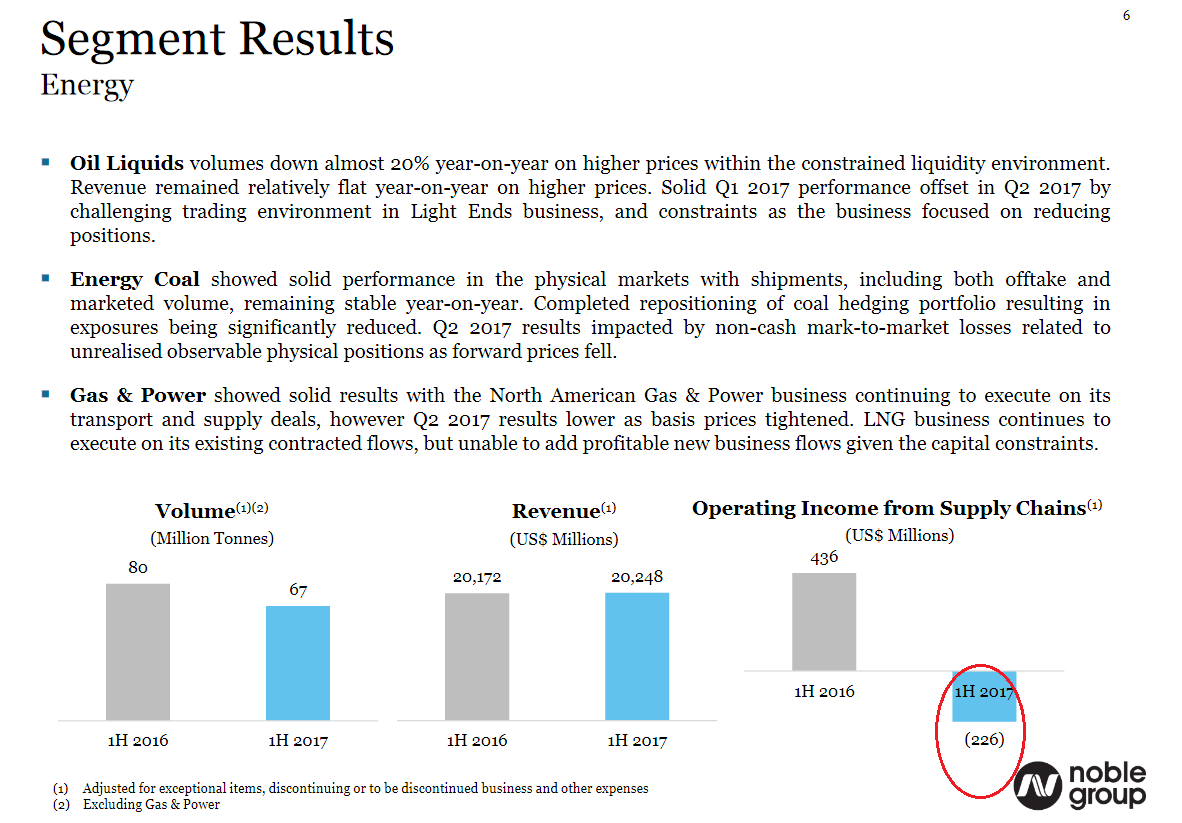

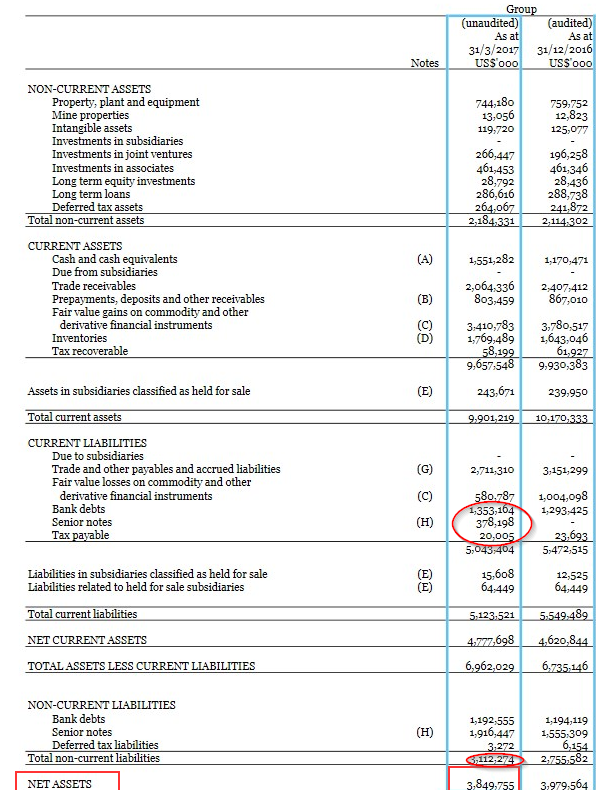

Noble Group has booked gains on these contracts to the tune of 102% of shareholder equity as of April 2017.

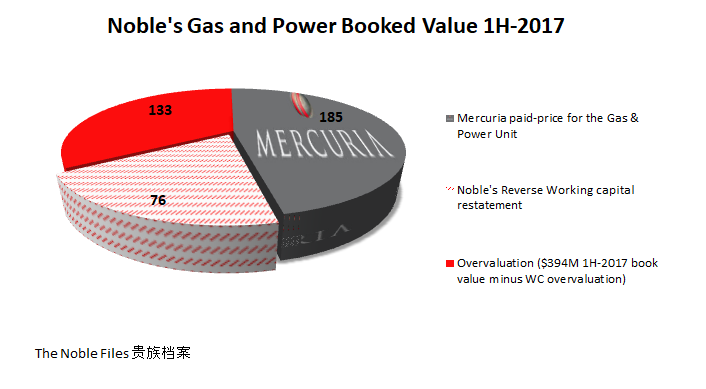

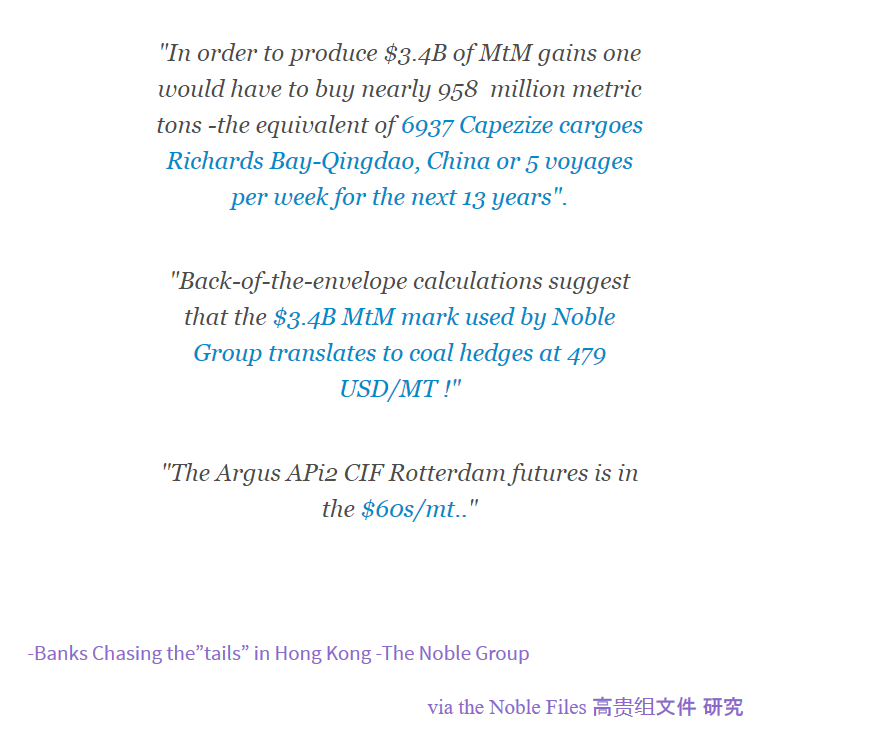

The company has unrealistically booked large profits on long-dated contracts ($3.6B), the value of which relies on input assumptions that are not market-observable…

Two small things to worry about Noble’s are the valuation and the uncertainty of the cash realization of these gains.

One of these gains booked is on a 10 years offtake agreement with Sundance Resources (problem: it’s a junior Australian miner with production starting in 2019 (opps!)

Noble has repeated that these contracts were correctly valued. Then in 2016, 48 hours before the publication of their FY15 annual results, Ernst & Young suddenly realized that these contracts had to be impaired by $1.1b.

At least if you were a buyer, you would expect to pay for assets generating positive cash-flows.

Problem is that Noble Group has generated negative cash-flows from the operations to the tune of and -$1600M in 2014, -$600M in 2015, and -$900M in 2016 (and I also reckon that its cash flows from operations didn’t even covered the cash interests expense of its debt service in Q2-2016…)

Noble group has no intrinsic value (by DCF).

It remains difficult to value them and put a ballpark price but no, the current price share doesn’t reflect the accounting issues and net equity issues of the trader.

OCBC bank and many analysts at brokerage houses bave simply stopped the coverage the company. Compliance officers now refuse them to cover the company on reputational risk.

It is also said in the market that the company is likely also good candidate for a downgrade by S&P.

The trader has lost its access to their counter parties in the commodity market because of stricter limitations to deal with them now. (must put down collateral to execute trades that in the past required none)

If one wishes to be very conservative:

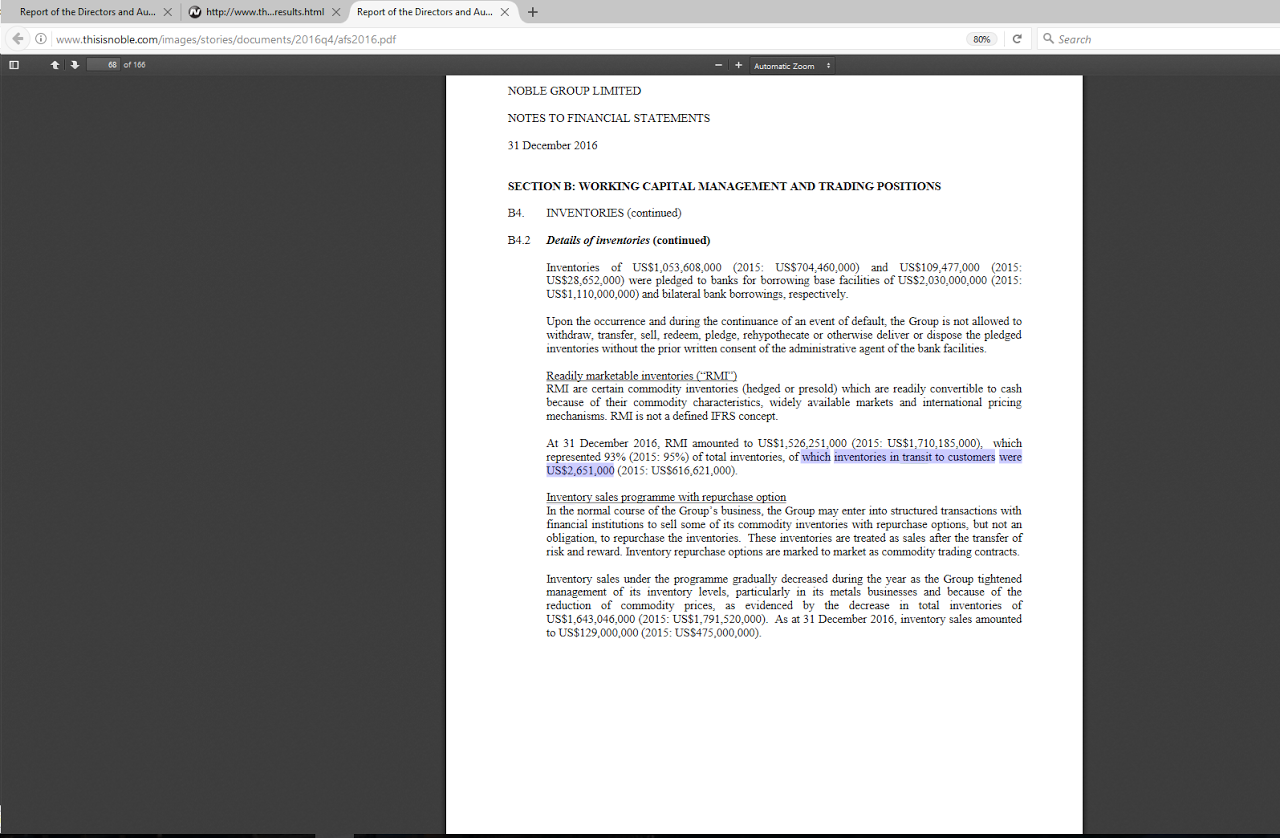

Exclude the $1.6B inventory from its liquidity- it belongs not to shareholders but to banks and is used by Noble as the collateral to pony up $5B borrowings with the banks (because Noble Group also celebrates the envied 4th position among the top 10 commodity borrowers in the world…).

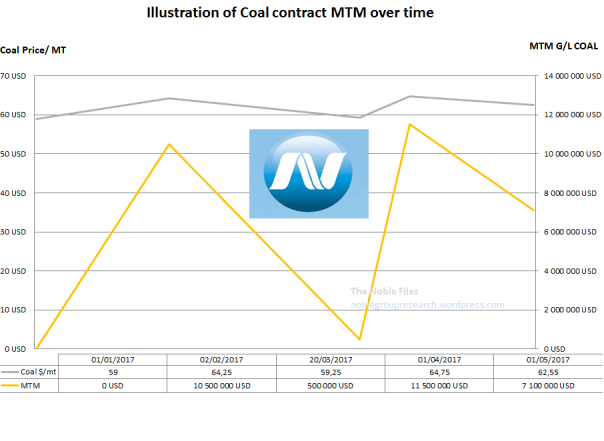

The cash realization of these gains:

Noble’s “Net Fair value on commodity and derivative instruments”. End FY 16, the net gain in fair value stands at 2,776,419,000 while end FY 15, it stood at 3,178,351,000.

Noble should have realized approximately 400,000,000 of gains, however cash flow shows its has only realized about 234,234,000 in gains (57% of the amount).

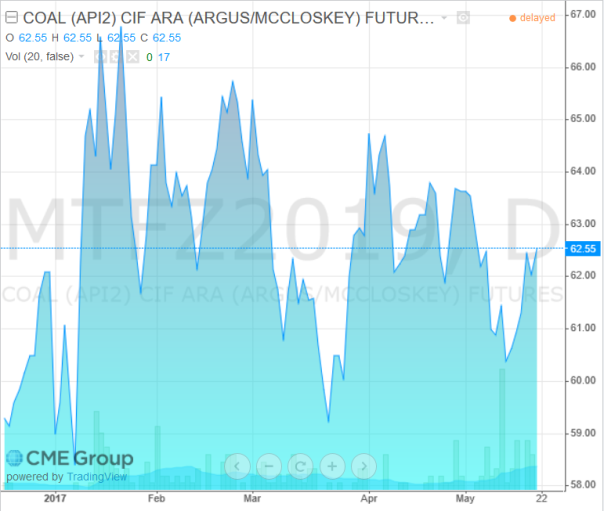

The valuation of these gains:

So one could conservatively remove the fair-value gains from Noble’s net equity computation, or give it a haircut of say 60%) when valuing the company.

Have you hear about something called inverse-leverage …

The problem is that it cannot be done because a depreciation net fair value G/L gains on commodity contracts of -19% would render Noble Group insolvent and precipitate the Asian trader into liquidation.

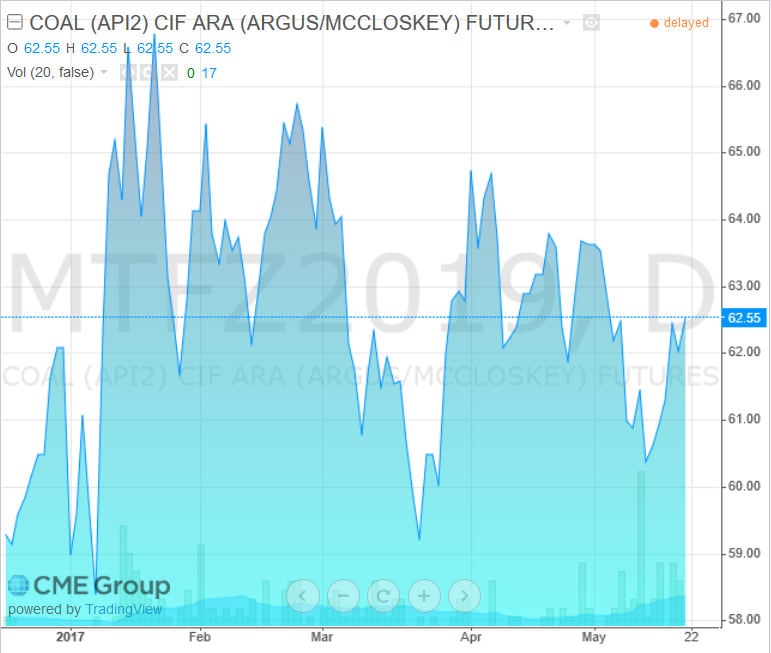

The further that the coal API2 curve goes on the Bloomberg terminal is 5 years… I’m curious how does William Randall, Coal Kingpin Australian brainmaster of Noble Group pulls out a 30 years mark-to-market gains. what’s that !

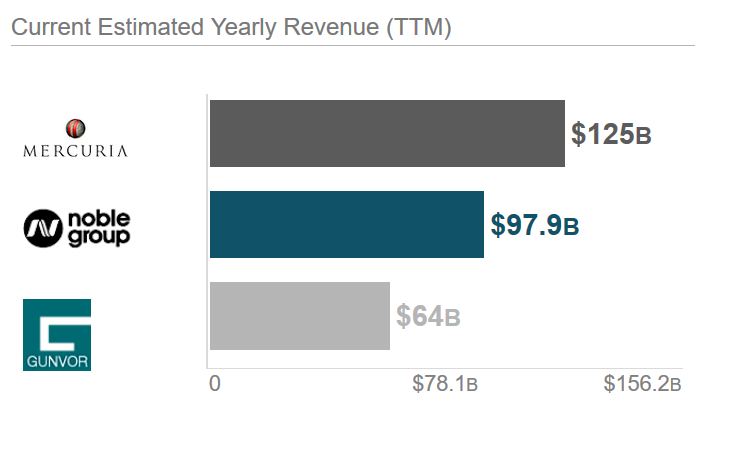

Do people realize that IF Noble Group contracts were properly valued a long time ago a credentiate trader (such Castelton Commodities) or and investor (like Temasek) could have bought them out.

This said, the thought process at Noble isn’t very different from the rest of the industry peers (Glencore…)

e.g MDs in independent units, under minimal supervision have crafted positions that have bleed into outright wagers. With limited trading views, constantly fight the HQ to punt more working capital.

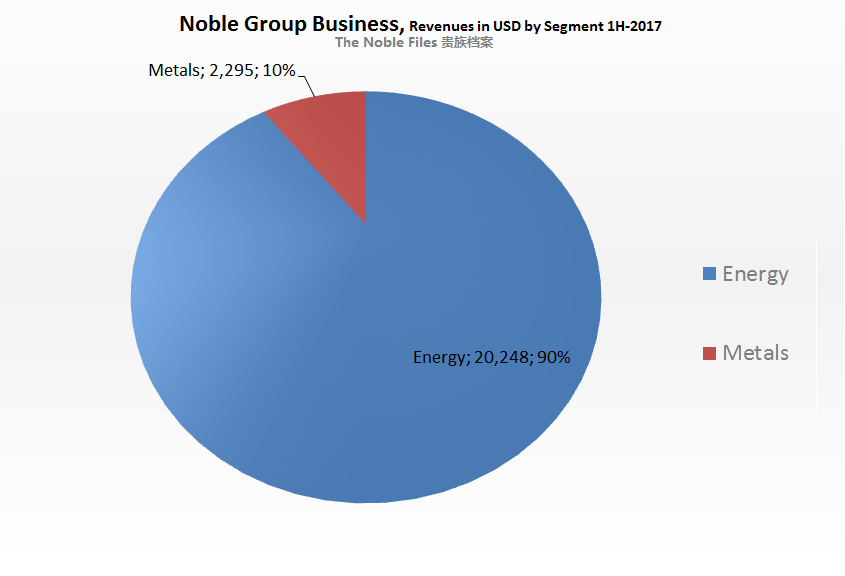

Their entrance in some commodity markets has been always marked by spectacular moves.

Their tactic has been volume is at any cost, throwing their weight around; (Noble Agri, Noble Americas…)

This has naturally created a pattern of brutal exits.