Noble’s Star Gasoline Trader Sinenko Said to Join Gunvor

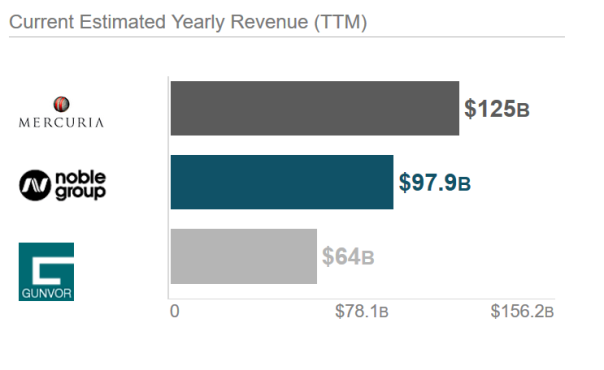

Gunvor Group Ltd. has wooed Noble Group Ltd.’s star gasoline trader to join its expanding U.S. operations as an exodus from the struggling Asian trading house continues amid asset sales and a debt restructuring.

Dmitri Sinenko, one of Noble’s top performing oil traders, has agreed to join Gunvor’s U.S. operations… -Bloomberg

There is a few myths and misconceptions in the presser starting by STAR ??? Hello star.

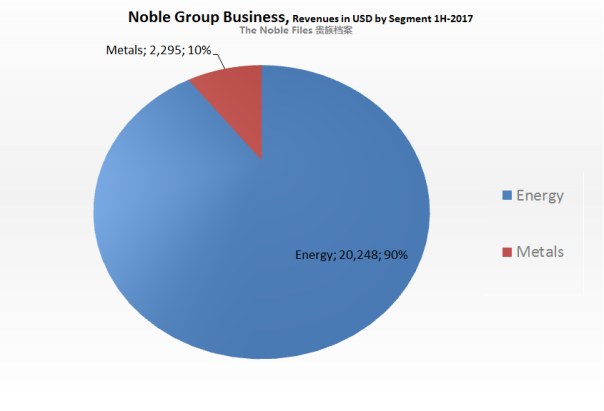

On the cash-flows statement basis the U.S pipeline trade is absolutely what has killed any ray of hope for Noble of breakeven and paying back the borrowing base. https://noblegroupresearch.wordpress.com/?s=oil+liquids

The ‘Co-Stars’

.

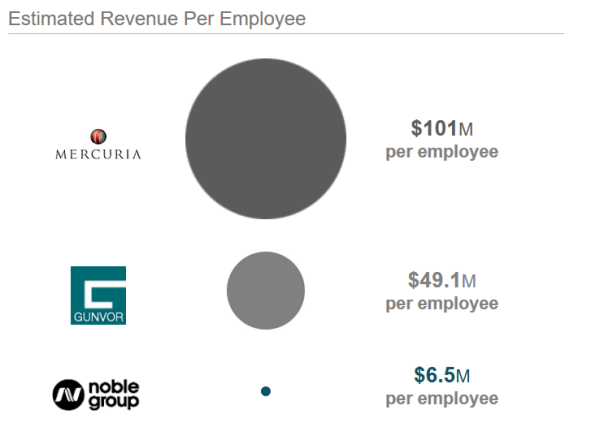

In our book, the co-stars Dmitri https://noblegroupresearch.wordpress.com/tag/dmitri/ and Jeffrey “Chief Relaxation Officer ” VICE president and CO-CEO Frase, simply put, are synonym of two high rollers overheads.

.

Noble Americas Oil Liquids was Noble’s last hope and they have bet everything on the same horse.

For the records they were given a blank card and what they did with it was roulette “double the stakes or quit” losing million dollars in negative cash flows per day depending on how you read how Noble torture its operating income from supply chain and non-cash mark-to-market unrealised observable positions or its (bogus) physical turnover.

.

If you want to know the real story of Noble Group, it is pretty simple: in trading you can’t be just a second or a third, it cannot and won’t work.

.

.

“Even with massive refineries shutdown of a historical proportion in the wake of Harvey flooding, Dmitri has not break-even, was losing Noble Americas Corp. half a million a day on his pipelines trades.”

.

A 3rd or a 2nd won’t make it. It’s not enough. You need to get everything right and 10/10, or the market will grind you down to the ground. Don’t hire bums.

.