Bizarre ING their case: No business but keeps restructuring… Proceeding without forensic investigation and while the client is under a police investigation. “But lets do it”.

Person A “…Q. so why is ING so hardup on supporting the Noble bandwagon? Surely, there are things going on behind the scenes.”

Person B “-Because they are losers.” like in anyone in that situation at some point who would be forced to do it (avoid the liquidation) saving their own skin.

If not, they could lose $400M”.

Human nature is complex, but predictable;

the good / evil .. .empathetic/ psychotic.. … …. peace / war……… ….moral /amoral....

ING/ the Anthony Van Vliet

Person A Q.”Isn’t it strange and suspicious at least that ING has proceeded so quickly into the early beginnings of this investigation and without a full forensic audit of Noble before moving into December 24th Christmas “..Don’t understand why they would publicize this.. the singapore police is investigating”.

Person B “Yeah saw that”

” the golden rule should be silence…”

But I’m not in their shoes.

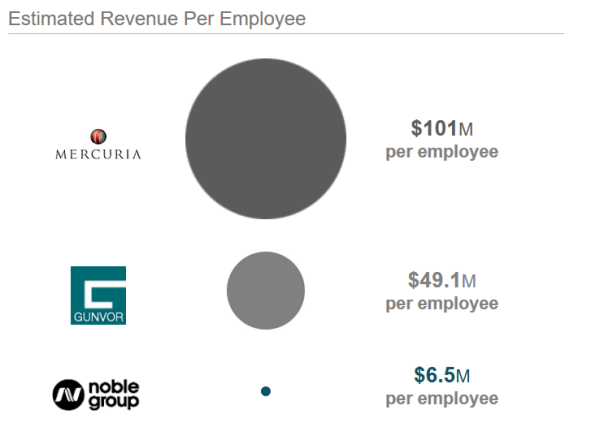

Just know that Goldman Sachs came and cut em off.

“GS made a ton of millions when betting against Noble and the banks on the other side of the Trade.”

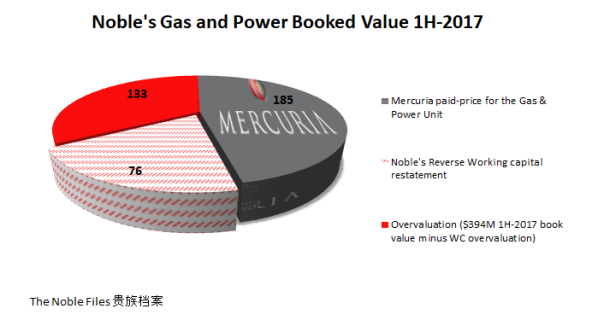

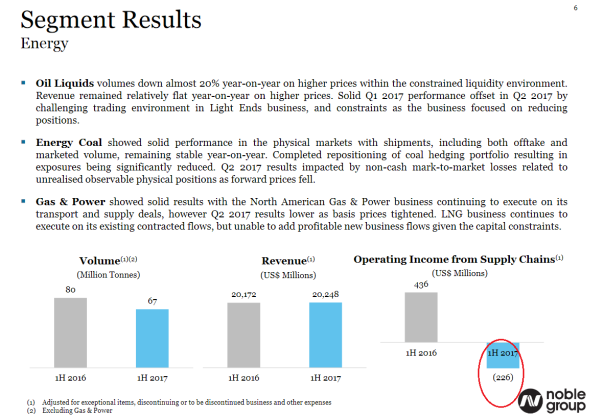

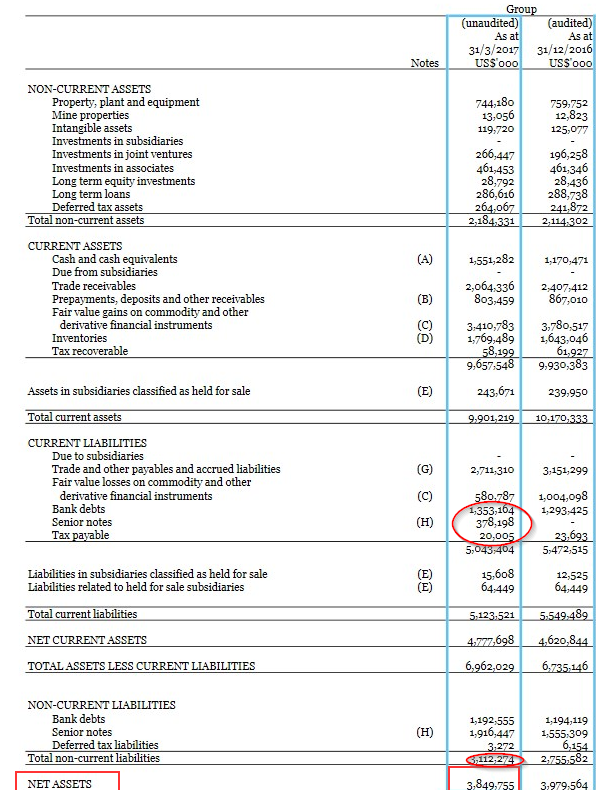

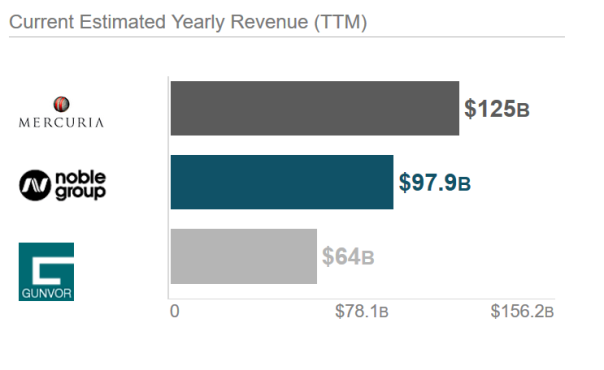

Person A ” The authorities say the simulated financial statements show that the net asset value (NAV) of New Noble as at Dec 31, 2017, could be adjusted downwards by about 40%, and that the NAV as at Mar 31, 2018 could be adjusted downwards by about 45%.

These adjustments would be in addition to the write-downs of more than US$2 billion ($2.7 billion) already made by Noble in 2017.

Arising from investigations by CAD and MAS, the authorities point out that there could be even further reductions in New Noble’s NAV that extend beyond the potential non-compliances with accounting standards highlighted by ACRA.”

Person B ” more is coming”.

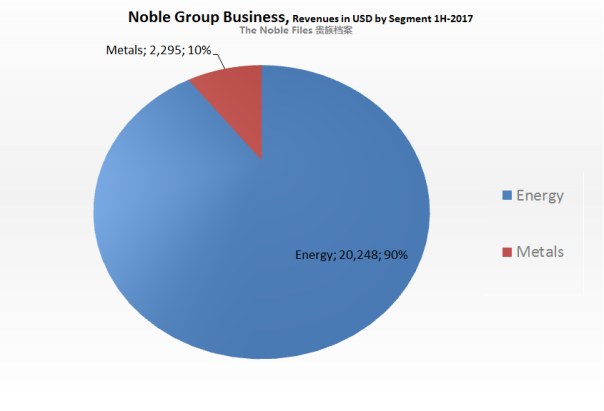

Interesting enough, they keep restructuring and equity but no word about the business.

Person A: and this is bad, the SG authorities, at least, deserve credit. By not allowing them to re-list on the exchange, they did right.

Person B : Do not lose faith in Singapore and the Authorities.

Justice will prevail.

Person A: Q. Would the banks acting in the perephery of Noble also be part of the Investigation ?

Person B –Absolutely and the on-going existence of Noble as a private entity could be proven a “Forward liability”.

The Noble Files 贵族档案