Noble Resources International Pte. Ltd. and Terracom investee at heart of a cheating and bribery scandal.

▪︎Using $ to make offspec cargoes onspec or change certain parameters to the exact numbers they want. unlawful.

The Noble Files 贵族档案

Aussie coal analysis scandal triggers Korean power ban

The bids are for shipments of 290,000 metric tons to 310,000 tonnes of coal. “ALS Limited … is not allowed as an international independent inspection agency,” say the bid documents.

ALS was not banned in previous bidding documents viewed by The Australian Financial Review.

The moves follow ALS in April telling the market its Australian coal unit had “manually amended without justification” between 45 per cent and 50 per cent of final certificates since 2007. All the changes boosted the quality of the coal, and ALS is one of the major players in the Australian export sector.

ALS, which said an internal investigation found no other wrongdoing in other divisions, has since removed a backdoor in processes that allowed changes in the coal certification unit.

An ALS spokesman said it had not received any formal communication from Korea South-East Power. But he said control checks since the investigation had been carried out on more than 650 certificates “to ensure there is direct correlation with all … test data”.

It has also taken its findings to the NSW police because of fears a serious offence had occurred.

“Investigations into this matter are continuing,” a police spokesperson said.

The Financial Review exclusively revealed the scandal in February, after finding court documents alleging ALS had been involved in tampering results.

A former senior manager of Queensland miner TerraCom had made allegations of fraud in a workplace dismissal lawsuit.

The manager alleged TerraCom had been using ALS to falsify results for exports of more than a dozen coal shipments to China, Korea and Japan. TerraCom has denied the allegations entirely and said “to suggest TerraCom was involved in an international conspiracy to undertake false testing is ludicrous”.

No customers had raised any quality control issues, TerraCom also said.

Among the export certificates filed in the legal dispute include details of a $10 million, 146,938 ton shipment from TerraCom in May 2019 with Korea South-East Power marked as the end user. The documents alleged the moisture content had been artificially improved from 15.9 per cent to 15 per cent, between initial reports and final certificates.

The net calorific content, measuring the energy thrown off when burned in power stations, had been allegedly falsely boosted from 5398 kilocalories per kilogram to 5495 kcal/kg.

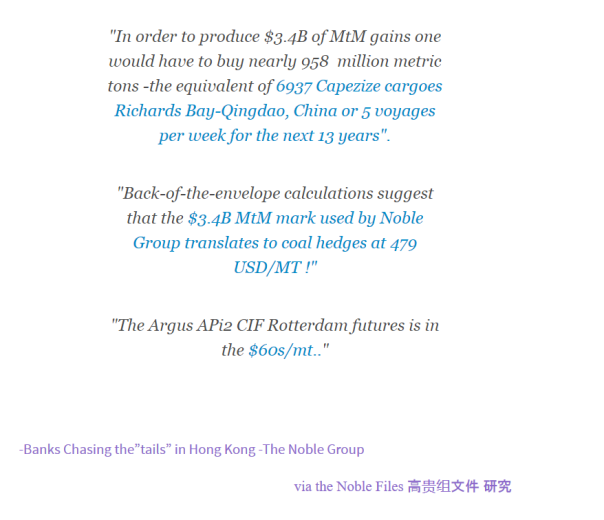

The shipper was marked as Noble Resources International, part of the Singapore-based Noble commodities trading outfit. The former manager’s lawsuit alleged Noble was involved in paying bribes so customers did not raise the alarm. Noble has declined to comment.

Korea Electric Power Corporation has referred questions to its subsidiaries, and Korea South-East Power has not responded to multiple queries.

The action against ALS in the power company’s tender documents comes after industry sources maintained that falsification was “endemic” across the sector and labs changed results to keep contracts with miners.

Court documents filed by TerraCom’s former manager also said Geneva-based testing outfit SGS had falsified results, but the laboratory business dismissed the allegation after a “technical review”.

Other major testing companies including Intertek and Bureau Veritas have not answered queries. Industry umbrella organisation the TIC (Testing, Inspection and Certification) Council has referred queries back to individual companies, saying it was the “first time” it had heard of such a problem.