Noble Group at the dusk of an agonising death spiral.

The only reproach that one could do to Iceberg Research is that he didn’t communicate well enough his message so people understand the negative significance of this $3.4B MtM or on what Noble Group (來寶集團) underpins its financial substance: a skeleton.

What is MtM and how a $3.4B MtM would translate into coal hedges)…

Mark-to-market (M-t-M)

To mark-to-market is to calculate the value of a financial instrument (or portfolio of such instruments) at current market rates or prices of the underlying.

Example for illustrative purpose:

On 1 Jan 2017: Noble buys 2,000,000 MT for June 2019 delivery at $59/mt. It turns immediatly in the derivatives market and sells the equivalent of 2,000,000 MT of paper contracts. This is the Coal API2 Argus futures contracts.

This is the Coal API2 Argus Futures Contracts.

Timeline

1 Jan 2017: Noble has a +MtM of 0 (Contract price is $59 and the Argus Futures is at $59)

1 Feb 2017: The Argus Coal API2 futures is at $64,25. The +MtM on the coal contract is +$10,5M

20 March 2017: The Argus API2 Futures dropped to $59,25/MT The +MtM on the coal contract is +$500K

1 May 2017: The Argus API2 settled at 62,55 and the +MtM on the coal contract is now +$7,1M

–

Noble Group MtM on Coal contract:

–

At any given time, the 2,000,000 MT of Coal produces a MtM gains between $500K and $11.5 millions.

Capezize Ship

When Noble announced a first-quarter loss of $130m— it blamed largely on ill-judged coal trades—and it warned that it might not return to profitability until 2019.

Can you better put in context the warning that it might not return to profitability until…

These “Hedging losses” are rather because of a mismatch between the level of profits booked on these contracts and their underlying cash-flows.

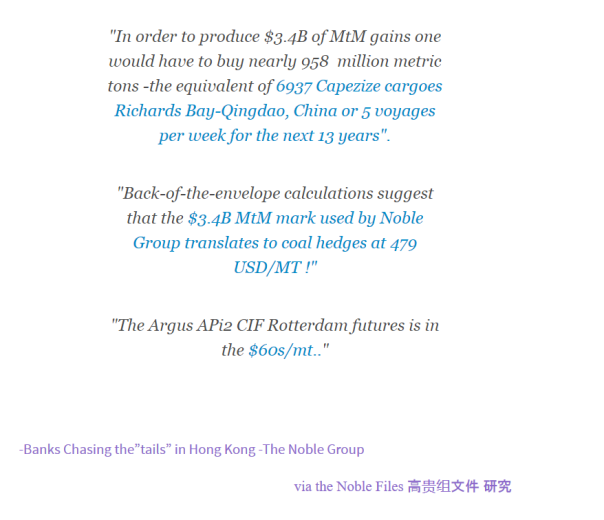

In order to produce $3.4B of MtM gains, Noble would have to buy not 2,000,000 MT of coal , as in this example, but book nearly 958 million metric tons – the equivalent of 6937 Capezize cargoes Richards Bay-Qingdao, China or 5 voyages per week for the next 13 years…

This represents a considerable tonnage even for the largest firms of the industry (Cargill, Rio Tinto, BHP, Vale, Anglo American) all put together and more than 1.21 year of world coal production*

**According to BP statistical review of word energy 2016, the world coal production was 786.1 million tonnes (2015)…