Noble had two or three large and lucrative take-of-pay deals in the U.S but the wind has changed as it always does in the physical energy markets.

How the “core assets” (contracts) are now performing ?

Oil liquids had an EBIT of $646M in 2015, thanks specifically to three deals on Colonial, Magellan and Explorer pipelines. noblegroupreasearch.wordpress.com 2016/06/06

Noble has confirmed that it is losing money since at least 8mth on the pipelines as we predicated earlier. noblegroupresearch.wordpress.com2016/11/21

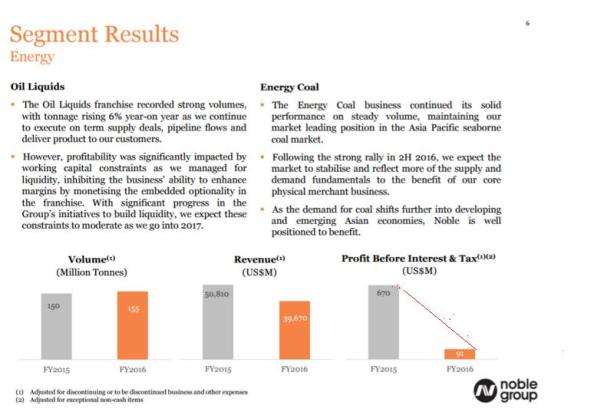

Noble Group Financial Performance Presentation FY16

Note the

“However, profitability was significantly impacts by working capital constraints as we managed for liquidity, inhibiting the business’ ability to enhance margins by monetizing the embedded optionality in the franchise”

The U.S oil liquids business has operated at a loss $23M during Q4-2016.

Now caught in-between, with losing positions the trader frames it as “it’s because of liquidity constraints” as it tries to sell this U.S oil liquids unit to Sinopec.

This is the also company who has burned $900 millions in OPERATING CASH-FLOWS in 2016 but printed an accounting profit… only figure.

The Noble Files 贵族档案